I mentioned the other day that it’s coming up on ten years since I bought my house in Bentleigh (hence the flurry of maintenance).

In that time, the prices here have gone through the figurative roof.

I didn’t think to save the data at the time, but this document tracks median house prices around Victoria from 1998 to 2008.

In 2005, the median in Bentleigh was $501,000. By 2007, it had shot up to $713,750.

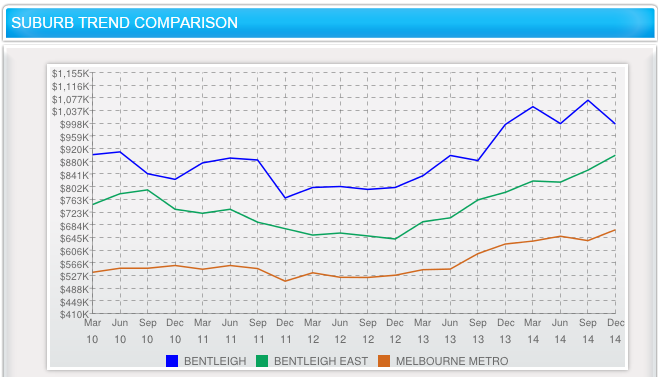

There’s a gap in my info for a couple of years, but it got to about $910,000 by June 2010, before rising and dipping and dropping back to about $765,000 in December 2011.

As you can see from the graph, since then it’s climbed steadily: Figures in The Age recently indicate 14.4% growth in the past year, to a dizzying $1,003,000.

So not only has the median price now gone up about a million dollars, but it’s also doubled in the not-quite-ten-years since I bought.

I should note that although I own a house, it’s on a half-block of land, having been subdivided about ten years before I bought it. The rear garden is a mere courtyard, and it’s really only two-and-a-half bedrooms — all of which means I paid less than the median price.

The increase since means I lucked out on a good investment. Not that I’m planning to sell.

But it also means if I were house-hunting now, I’d be priced out of the suburb I’ve come to know and love.

And with my kids almost grown, I really wonder what the implications are for them and their peers.

Will the next generation be stuck as renters? Not that there’s anything wrong with that, but it’s nice to have the option to buy.

The alternative is to buy much, much further out, in suburbs with less amenity and walkability.

Bentleigh East is more affordable than Bentleigh, but is less walkable. Although the street layout is pretty good, access to amenities is reduced: Walkscore says 59 in BE vs 75 in B. And BE is mostly well beyond walking distance to the train network. Even then it’s not much more affordable — only about 10% cheaper, with a median price still over $900,000.

As others have pointed out, the capped public transport fares mean that if train/city access is your priority, it’s now better to look down the line than across from it. Think about travel time, rather than distance as the crow flies.

How long to the city? Metropolitan Town Planning Commission map circa 1920 — See blog post

For instance, along the Frankston line, spend another 10 minutes on the train (instead of fighting your way into the station car park every morning, or battling with hopeless feeder buses or facing a long walk) and you can be in somewhere like Edithvale, Chelsea or Carrum, at a cost of about 40% less than Bentleigh.

I’m sure it’s similar on other lines — though beware of train service frequency. For instance, out from Sunshine is quite good towards Sydenham, but the trains to Deer Park are hopelessly infrequent.

Of course there are other factors such as proximity to friends and family, crime levels, access to schools and shops and parkland.

And it’s still expensive of course. If you’re house hunting, or will be in the future, I wish you the very best of luck.

11 replies on “House prices in Bentleigh top $1 million – I couldn’t afford it here now”

“I really wonder what the implications are for [my kids]”.

Well, for one thing, they’ll inherit a truck load of money from their old man!

We recently sold in Bentleigh East, whilst hunting for a new home we have discovered that it is actually more affordable in Brighton East! Honestly though I would not want to leave bentleigh area, it has everything right on my doorstep & a friendly neighborhood.

In a way it is an investment as it does give you more options when you are old and its value ensures your children will always treat you well.

I remember buying my property in early 2010 and being absolutely elated that I managed to get into the property market at a relatively young age. Come 2011/2012 when the value was less than I paid for it, and I was ruing my decision.

Of course, it’s all swings and roundabouts, and three years after the downturn, my apartment’s back up and I’m doing a lot better than many of my peers who absolutely despair at their chances of ever being able to buy a property.

It’ll be a property that I hold onto until my husband and I decide to have more children than can fit into a two bedroom apartment, necessitating a move to a bigger unit further out…probably Edithvale as you’ve observed, or Springvale!

If this goes on only the 1% will be able to buy properties – and the 99% will need to find the rent.

If you aren’t happy where you are: you’ll have to stay there – or move further out.

I got a mortgage in 2006. I certainly couldn’t afford to buy property now.

It seems that the Age is getting it’s ideas from you again Daniel.

Not really into the housing market, but a few posts recently have indicated a pattern that housing prices in the older boundaries of Melbourne (say, Zone 1 plus a few KM) seem to be around five or six times what the current residents could afford if they were to move in now.

A pattern like that can’t be healthy.

No, it’s not healthy. There’s no doubt about it, this situation is disgusting.

The papers (and the Government) bleat on about foreign investment, but I feel that it is much more to do with bank lending policies. We need LVR restrictions; New Zealand has them, but I doubt they’ve gone far enough.

Many years ago, it was common for banks to restrict lending to 50% or 80% (depending on whether you pick 1975 or 1990) of property value – the LVR (Loan-Valuation Ratio). Now, you commonly see adverts for 95% to 110% of valuation, and I hear Acme Cheapo Homes screeching “Three thousand dollar deposit” at the top of their voice (amounting to a loan of 98% even on their Cheap-N-Nasty homes). The bank also outlined to me in 1989 that they restricted loans so that the Front-end ratio (repayments as percentage of income) was no more than 35%. Not entirely sure what rule they use now, if any.

This is bad/unproductive. From a mathematical perspective, when deposits decrease from 20% to 5% (LVR increasing from 80% to 95%) it prompts those who have saved a particular deposit to look for more expensive properties, which drags the market up. Eventually, the same people will be targeting the same properties, but at prices that are four times what they were before.

One could argue that the homes are better, but that does not explain the median price surge: from 3.4 times annual salary to 8.1 times annual salary (from 1973 to Sep 2014). The banks will say they’re “trying to help the battlers”, but the real beneficiaries are the builders. I must confess I have yet to check the supply situation, but even if that were to be a problem, prices simply would not increase the way they have if bank lending continued to be restricted to 80% LVR.

This country needs an honest discussion about housing affordability, and I think that LVR and front-end ratios need to be fairly central to that discussion.

A website that might be worth looking at, directed at housing affordability (including rental affordability) http://housingstressed.org.au/ . Hopefully some honest discussion can occur there?

Concerning the next generation: About 12 years ago, I observed an interesting phenomenon. I moved from my smallish city to a much larger city – my rent was significantly more expensive, as was the real estate market. In the city I moved from, it was typical for older children to move out and rent to attend post-secondary school, or start their first job after high school. However, in the much larger, more expensive city, it was more typical for grown children to remain living with their parents until they could afford their own home – even to the point that they were in long-term relationships or married, but still living with one or both parents.

I only spent a year there, before moving back to my home city, and since then, I have observed the trend I expected to see develop – as house prices have increased, and salaries have not increased comparably, more older children are choosing not to move away, instead building up savings towards a house purchase.

This rears its ugly head again. While Joe Hockey forces the sale of one house (foreign buyer), he has also thrown open an idea to use superannuation to purchase a (first?) home.

I say no.

Apart from fuelling the problem of people bidding up housing prices (alongside high LVRs), it is inequitable. Those without super (because they’re fresh into the workforce or fresh from overseas) are effectively excluded. Also those who rent cannot use their super to meet their costs.